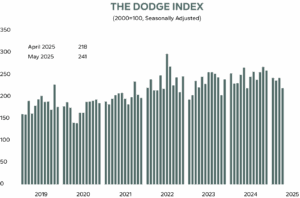

Growth in select sectors offers a counterpoint to April’s slowdown.

BOSTON, MA — May 21, 2025 — Total construction starts were down 9% in April to a seasonally adjusted annual rate of $1.03 trillion, according to Dodge Construction Network. Nonresidential building starts declined 3%, residential starts fell 4%, while nonbuilding starts decreased 22%. On a year-to-date basis through April, total construction starts were down 3% from last year. Nonresidential starts were down 10%, residential starts were down 5%, and nonbuilding starts were up by 8% over the same period.

For the 12 months ending April 2025, total construction starts were up 2% from the 12 months ending April 2024. Residential starts were flat, nonresidential starts were up 1%, and nonbuilding starts rose 5% over the same period.

“Broad-based monthly declines in construction starts represent a troubling signal for the sector,” stated Eric Gaus, chief economist at Dodge Construction Network. “While not definitive, the slowdown in April aligns with delays in the planning pipeline and other economic data that capture the volatility and uncertainty of all the April tariff announcements. Uncertainty around trade policy and the economy’s direction will continue to weigh on construction activity in the coming months.”

Nonbuilding

Nonbuilding construction starts fell 22% in April to a seasonally adjusted annual rate of $279 billion. Highway and bridge starts decreased 8%, environmental public works fell back 2%, and utility starts were down 70% last month. Meanwhile, miscellaneous nonbuilding starts were up a strong 57% in April. On a year-to-date basis through April, nonbuilding starts were up 8%, with utility/gas starts up 37%, miscellaneous nonbuilding up 5%, highway and bridge starts up 7%, and environmental public work starts down 7% over the same period.

For the 12 months ending April 2025, total nonbuilding starts were up 5%. Environmental public works improved 13% compared to the 12 months ending April 2024. Highway and bridge starts were up 4%, miscellaneous nonbuilding starts were up 16%, and utility/gas starts were down 6% over the same period.

The largest nonbuilding projects to break ground in April were the $1.8 billion Hudson Tunnel Project (Manhattan Tunnel) in New York, New York, the $775 million West Alabama Highway project in Thomasville, Alabama, and the $365 million Carpenter Wind farm (200 MW) in Carpenter Township, Indiana.

Nonresidential

Nonresidential building starts receded 3% in April to a seasonally adjusted annual rate of $391 billion. Commercial starts were 21% lower in April, alongside weaker retail, office, and warehouse starts. Institutional starts, on the other hand, were up 2% last month following stronger healthcare and education starts. Manufacturing starts grew 78% over the month, as well. On a year-to-date basis through April, nonresidential starts are down 10% compared to April 2024. Commercial starts are up 3% and institutional starts are down 4% over the same period.

For the 12 months ending April 2025, total nonresidential starts were up 1% compared to the 12 months ending April 2024. Commercial starts were up 12%, institutional starts improved 9%, and manufacturing starts were down 46% over the same period.

The largest nonresidential building projects to break ground in April were the $1 billion Kaiser Permanente Medical Center in Sacramento, California, the $940 million Bally’s River West Hotel and Casino in Chicago, Illinois and two buildings for the GM & Samsung SDI Battery Cell Factory in New Carlisle, Indiana – valued at $855 million and $875 million respectively.

Residential

Residential building starts fell 4% in April to a seasonally adjusted annual rate of $360 billion. Single-family starts decreased by 5%, while multifamily starts receded 3%. On a year-to-date basis through April, residential starts are down 5%, with single-family starts down 6% and multifamily starts down 4%.

For the 12 months ending April 2025, total residential starts were flat. Single-family starts were up 3% and multifamily starts were down 7% compared to the 12 months ending April 2024.

The largest multifamily structures to break ground in April were a $331 million residential and retail development in Jersey City, New Jersey, the $256 million Vista Point apartments at Fairview Life Care Community in Groton, Connecticut, and the $226 million Rambler Riverfront District apartments in West Lafayette, Indiana.

Regionally, total construction starts in April rose in the Midwest, and declined in the Northeast, South Atlantic, South Central, and West.

###

About Dodge Construction Network

Dodge Construction Network harnesses data, analytics, and industry connections to be the leading source of insights and opportunities in the commercial construction industry. With five trusted solutions-Dodge Construction Central, The Blue Book, Sweets, IMS, and Principia-Dodge connects construction professionals across all stages of the building process. Designed for both small teams and large enterprises, these tools simplify complexity, empowering you to build thriving businesses and communities. With over a century of experience, Dodge Construction Network is the catalyst for modern construction. To learn more, visit .

Media Contact:

| **@**********on.com