Nonbuilding and multifamily activity led this month’s growth

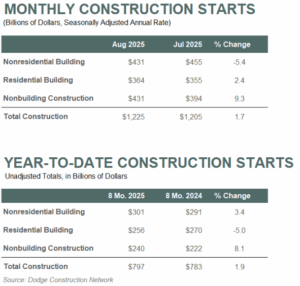

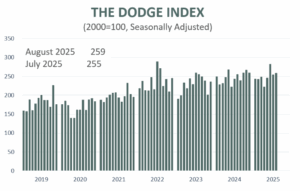

BOSTON, MA — September 19, 2025 — Total construction starts were up 1.7% in August to a seasonally adjusted annual rate of $1.23 trillion, according to Dodge Construction Network. Nonresidential building starts declined by 5.4%, residential starts improved 2.4%, and nonbuilding starts grew 9.3% over the month. On a year-to-date basis through August, total construction starts were up 1.9% from last year. Nonresidential starts were up 3.4%, residential starts were down 5.0% and nonbuilding starts were 8.1% higher over the same period.

For the 12 months ending August 2025, total construction starts were up 4.7% from the 12 months ending August 2024. Residential starts were down 1.2%, nonresidential starts increased 4.8%, and nonbuilding starts were up 12.1% over the same period.

“Construction activity continues to present a mixed picture,” stated Sarah Martin, Associate Director of Forecasting at Dodge Construction Network. “August growth was concentrated in a few key sectors, while single-family and commercial projects experienced broad declines. Large-scale megaprojects continue to support overall activity, but with mounting signs of economic softness, the pace of growth is beginning to moderate.”

Nonbuilding

Nonbuilding construction starts expanded 9.3% in August to a seasonally adjusted annual rate of $431 billion. Utilities (+39.7% m/m) supported this month’s growth, while highway and bridge (-5.6% m/m), environmental public works (-2.8% m/m), and miscellaneous nonbuilding (-3.1% m/m) starts fell back. On a year-to-date basis through August, nonbuilding starts were up 8.1%, alongside gains in highways and bridges (+7.8% m/m), miscellaneous nonbuilding (+22.6% m/m), and utilities (+12.6% m/m). Conversely, environmental public works starts are down 3.4% year-to-date through August.

For the 12 months ending August 2025, total nonbuilding starts were up 12.1%. Environmental public works improved by 10.8% compared to the 12 months ending August 2024. Highway and bridge starts were up 11.1%, miscellaneous nonbuilding starts were up 30.5% and utility/gas starts increased 5.4% over the same period.

The largest nonbuilding projects to break ground in August included the $5.1 billion Woodside Louisiana LNG Facility (Train #3, Phase 1) in Sulphur, Louisiana, the $2.9 billion Cheniere Corpus Christi LNG Facility (Trains 8 and 9, Stage 3B) in Gregory, Texas and the $1.8 billion Kingston Energy Complex with Battery Storage in Kingston, Tennessee.

Nonresidential

Nonresidential building starts declined 5.4% in August to a seasonally adjusted annual rate of $431 billion. Commercial starts were down 12.0%, as all sectors faced month-to-month declines. Most notably, warehouse starts fell back 25.3% and retail stores declined 11.3% between July and August. Institutional starts improved 3.7% driven by stronger activity in education (+0.5% m/m), healthcare (+2.8% m/m) and other institutional categories (+9.9% m/m). Manufacturing activity remains volatile, as the sector dropped 24.4% in August, following last month’s 84.8% drop. On a year-to-date basis through August, nonresidential starts are up 3.4% compared to August 2024. Commercial and industrial starts are up 7.6% and institutional starts are down 0.7% over the same period.

For the 12 months ending August 2025, total nonresidential starts were up 4.8% compared to the 12 months ending August 2024. Commercial starts were up 17.4%, institutional starts improved 6.1%, and manufacturing starts were down 27.4% over the same period.

The largest nonresidential building projects to break ground in August were the $880 million Geisinger Medical Center Tower in Danville, Pennsylvania, the $666 million Fort Meade East Campus Office Building in Fort Meade, Maryland, and the $540 million UM Shore Medical Center in Easton, Maryland.

Residential

Residential building starts increased 2.4% in August to a seasonally adjusted annual rate of $364 billion. Single family starts declined 5.4%, while multifamily starts expanded a steady 15.5%. On a year-to-date basis through August, residential starts are down 5.0% – with single family starts down 11.7% and multifamily starts up 9.9%.

For the 12 months ending August 2025, total residential starts fell 1.2%. Single family starts fell 5.9% compared to the 12 months ending August 2024, and multifamily starts increased 8.6% over the same period.

The largest multifamily structures to break ground in August were the $619 million Kuilei Place Mixed-Use Residential Tower in Honolulu, Hawaii, the $413 million 120 Brickell Residences in Miami, Florida and the $383 million Coles Street Mixed-Use Development in Jersey City, New Jersey.

Regionally, total construction starts in August rose only in the South Central (+53% m/m) and declined in the Northeast (-25% m/m), Midwest (-10% m/m), South Atlantic (-2% m/m) and West (-12% m/m).

###

About Dodge Construction Network

Dodge Construction Network harnesses data, analytics, and industry connections to be the leading source of insights and opportunities in the commercial construction industry. With five trusted solutions-Dodge Construction Central, The Blue Book, Sweets, IMS, and Principia-Dodge connects construction professionals across all stages of the building process. Designed for both small teams and large enterprises, these tools simplify complexity, empowering you to build thriving businesses and communities. With over a century of experience, Dodge Construction Network is the catalyst for modern construction. To learn more, visit .

Media Contact:

| **@**********on.com