Other nonbuilding and data centers led this month’s growth

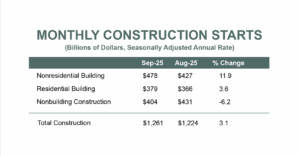

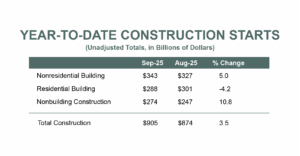

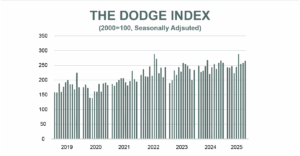

BOSTON, MA — October 19, 2025 — Total construction starts were up 3.1% in September to a seasonally adjusted annual rate of $1.26 trillion, according to Dodge Construction Network. Nonresidential building starts rose by 11.9%, residential starts improved 3.6%, and nonbuilding starts fell 6.2% over the month. On a year-to-date basis through September, total construction starts were up 3.5% from last year. Nonresidential starts were up 5.0%, residential starts were down 4.2% and nonbuilding starts were 10.8% higher over the same period.

For the 12 months ending September 2025, total construction starts were up 6.7% from the 12 months ending September 2024. Residential starts were down 1.4%, nonresidential starts increased 6.8%, and nonbuilding starts were up 16.7% over the same period.

“September construction starts data marks the third month of steady improvements,” stated Eric Gaus, Chief Economist at Dodge Construction Network. “However, a 3% growth rate is just keeping up with inflation, and we need fourth quarter growth of 25% to match annual growth of 2024. Megaprojects continue to provide significant report; just six projects accounted for 12% of the total value in September.”

Nonresidential

Nonresidential building starts increased 11.9% in September to a seasonally adjusted annual rate of $478 billion. Commercial starts were up 21.2%, as only retail failed to grow over the month. Most notably, parking and service stations starts rose 30.1% and offices increased 32.6% between August and September. Institutional starts improved 0.9%, where strong activity in education and dorms (+25.8% m/m), other institutional categories (+11.9% m/m) offset a large decline in health care facilities (-47.8% m/m). Manufacturing activity remains volatile, as the sector jumped 45.2% in September, following last month’s 24.4% drop. On a year-to-date basis through September, nonresidential starts are up 5.0% compared to September 2024. Commercial and industrial starts are up 10.9% and institutional starts are down 0.8% over the same period.

For the 12 months ending September 2025, total nonresidential starts were up 6.8% compared to the 12 months ending September 2024. Commercial starts were up 22.5%, institutional starts improved 5.0%, and manufacturing starts were down 23.6% over the same period.

The largest nonresidential building projects to break ground in September were the $2.5 billion Hut 8 Data Center (West Feliciana Parish) in St Francisville, Louisiana, the $1.7 billion NYS Life Sciences Public Health Laboratory in Albany, New York, and the $1.2 billion Llano Data Center Phase 1 in Claude, Texas.

Residential

Residential building starts increased 3.6% in September to a seasonally adjusted annual rate of $379 billion. Single family starts increased 1.7%, while multifamily starts expanded 6.4%. On a year-to-date basis through September, residential starts are down 4.2% – with single family starts down 12.1% and multifamily starts up 13.2%.

For the 12 months ending September 2025, total residential starts fell 1.4%. Single family starts fell 7.6% compared to the 12 months ending September 2024, and multifamily starts increased 11.6% over the same period.

The largest multifamily structures to break ground in September were the $584 million Harborside 8 Mixed Use Residential – Commercial & Parking in Jersy City, New Jersy, the $575 million 5 Times Square Residential Conversion in New York, New York, and the $480 million Imperial Tower – Mixed Use-Hotel-Pool-Parking in Jersey City, New Jersey.

Regionally, total construction starts in September rose in the Northeast (+36.3% m/m), Midwest (+10.9% m/m), and West (+1.4% m/m) and declined in the South Atlantic (-0.3% m/m), and South Central (-10.6% m/m).

Nonbuilding

Nonbuilding construction starts fell 6.2% in September to a seasonally adjusted annual rate of $404 billion. Utilities (-62.5% m/m) was the sole category contracting, while highway and bridges (+7.4% m/m), environmental public works (+6.6% m/m), and miscellaneous nonbuilding (+116.5% m/m) starts offset the decline. On a year-to-date basis through September, nonbuilding starts were up 10.8%, alongside gains in highways and bridges (+7.4%), miscellaneous nonbuilding (+42.1%), and utilities (+12.9%). Conversely, environmental public works starts are down 2.2% year-to-date through September.

For the 12 months ending September 2025, total nonbuilding starts were up 16.7%. Environmental public works improved by 10.8% compared to the 12 months ending September 2024. Highway and bridge starts were up 10.2%, miscellaneous nonbuilding starts were up 46.1% and utility/gas starts increased 17.1% over the same period.

The largest nonbuilding projects to break ground in September included the $3.0 billion AirTrain Newark Replacement in Newark, New Jersey, the $2.7 billion Hugh Brinson Pipeline in Midland, Texas and the $1.1 billion Walnut Creek WWTP Renovation and Expansion in Austin, Texas.

###

About Dodge Construction Network

Dodge Construction Network harnesses data, analytics, and industry connections to be the leading source of insights and opportunities in the commercial construction industry. With five trusted solutions-Dodge Construction Central, The Blue Book, Sweets, IMS, and Principia-Dodge connects construction professionals across all stages of the building process. Designed for both small teams and large enterprises, these tools simplify complexity, empowering you to build thriving businesses and communities. With over a century of experience, Dodge Construction Network is the catalyst for modern construction. To learn more, visit .

Media Contact:

| **@**********on.com