Megaproject activity continues to dominate month-over-month growth

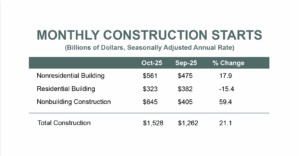

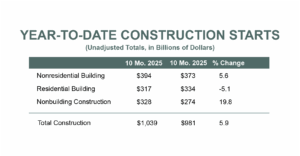

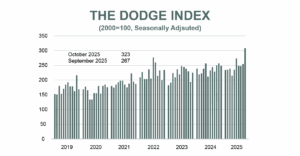

BOSTON, MA — November 21, 2025 — Total construction starts were up 21.1% in October to a seasonally adjusted annual rate of $1.53 trillion, according to Dodge Construction Network. Nonresidential building starts rose by 17.9%, residential starts declined 15.4%, and nonbuilding starts expanded 59.4% over the month. On a year-to-date basis through October, total construction starts were up 5.9% from last year. Nonresidential starts were up 5.6%, residential starts were down 5.1% and nonbuilding starts were 19.8% higher over the same period. For the 12 months ending October 2025, total construction starts were up 8.1% from the 12 months ending October 2024. Residential starts were down 3.1%, nonresidential starts increased 7.5%, and nonbuilding starts were up 22.9% over the same period.

“Growth in construction starts continued to be propped up by high-value megaproject activity last month,” stated Sarah Martin, Associate Director of Forecasting at Dodge Construction Network. “Specifically, ten projects valued at $1 billion and over broke ground, largely within data center, manufacturing and LNG construction. Outside of these high-tech buildings, however, growth appears more moderate. In square footage terms, for example, nonresidential and residential starts declined by 4.3% over the month and are down 5.4% year-to-date through October.”

Nonbuilding

Nonbuilding construction starts grew 59.4% in October to a seasonally adjusted annual rate of $645 billion. Utilities (+384.5% m/m) drove the surge, along with environmental public works (+18.6% m/m) and miscellaneous nonbuilding (+10.1% m/m). Highway and bridge starts declined by 23.7% over the month. On a year-to-date basis through October, nonbuilding starts were up 19.8%, alongside gains in miscellaneous nonbuilding (+54.0% m/m), utilities (+47.8%), highways and bridges (+4.1%) and environmental public works (+0.6%).

For the 12 months ending October 2025, total nonbuilding starts were up 22.9%. Environmental public works improved by 11.3% compared to the 12 months ending October 2024. Highway and bridge starts were up 5.6%, miscellaneous nonbuilding starts were up 52.6% and utility/gas starts increased 48.0% over the same period.

The largest nonbuilding projects to break ground in October included the $15.1 billion Calcasieu Pass LNG Export Terminal and Pipeline in Cameron, Louisiana, the $9 billion Rio Grande LNG Facility (Phase 2, Trains 4 & 5) in Brownsville, Texas and the $5.9 billion Frederick Douglass Tunnel Improvement in Maryland.

Nonresidential

Nonresidential building starts increased 17.9% in October to a seasonally adjusted annual rate of $561 billion. Commercial starts were up 19.5%, alongside growth in offices and data centers (+45.5% m/m) and retail stores (+15.1% m/m). Meanwhile, hotels (-19.3% m/m), warehouses (-1.7% m/m) and parking garages (-46.1% m/m) faced declines between September and October. Institutional starts improved 3.7%, driven by gains in other institutional categories (+49.5% m/m) – and offset by declines in education buildings (-20.8% m/m) and healthcare facilities (-2.7% m/m). Manufacturing activity remains volatile, surging 107.2% in October. On a year-to-date basis through October, nonresidential starts are up 5.6% compared to the first ten months of 2024. Commercial and industrial starts are up 13.6% and institutional starts are down 2.2% over the same period.

For the 12 months ending October 2025, total nonresidential starts were up 7.5% compared to the 12 months ending October 2024. Commercial starts were up 26.9%, institutional starts improved 0.2%, and manufacturing starts were down 16.3% over the same period.

The largest nonresidential building projects to break ground in October were the $7.5 billion Meta Hyperion Data Center in Richland, Louisiana, the $1.9 billion expansion to the LA Convention Center in Los Angeles, California, and the $1.7 billion Eli Lilly & Co. Manufacturing Facility in Lebanon, Indiana.

Residential

Residential building starts declined by 15.4% in October to a seasonally adjusted annual rate of $323 billion. Single-family starts increased 2.2%, while multifamily starts fell back a pronounced 38.5%. On a year-to-date basis through October, residential starts are down 5.1% – with single family starts down 12.3% and multifamily starts up 10.6%.

For the 12 months ending October 2025, total residential starts fell 3.1%. Single-family starts fell 9.4% compared to the 12 months ending October 2024, and multifamily starts increased 10.3% over the same period.

The largest multifamily structures to break ground in October were the $214 million Andare Residences in Fort Lauderdale, Florida, the $165 million 6 East 43rd Street Office-to-Residential Conversion in New York, NY and the $132 million Jefferson Bonnie Brae Apartments in Denton, Texas.

Regionally, total construction starts in October rose in the South Central (+84.9% m/m), Midwest (+18.8% m/m), South Atlantic (+8.7% m/m) and the West (+1.1% m/m). Starts declined in the Northeast by 40.1% between September and October.

###

About Dodge Construction Network

Dodge Construction Network harnesses data, analytics, and industry connections to be the leading source of insights and opportunities in the commercial construction industry. With five trusted solutions-Dodge Construction Central, The Blue Book, Sweets, IMS, and Principia-Dodge connects construction professionals across all stages of the building process. Designed for both small teams and large enterprises, these tools simplify complexity, empowering you to build thriving businesses and communities. With over a century of experience, Dodge Construction Network is the catalyst for modern construction. To learn more, visit .

Media Contact:

| **@**********on.com