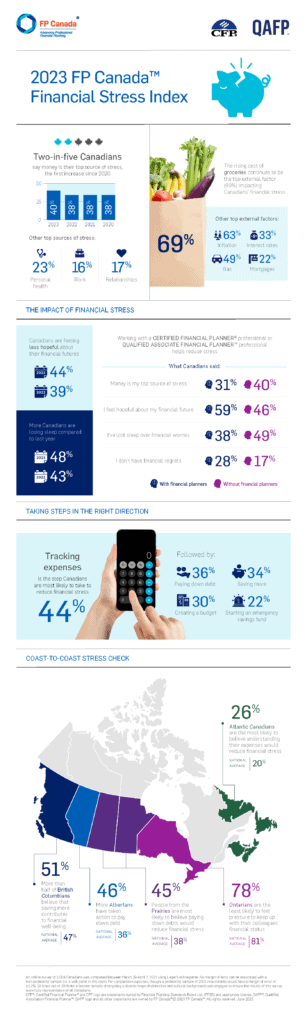

For the sixth year, money remains the top stressor for Canadians as rising inflation and elevated prices at the pump and for groceries are taking a toll on Canadians.

According to FP Canada’s 2023 Financial Stress Index, nearly half of Canadians have lost sleep over finances and one-in-three have experienced mental health challenges. The survey suggests that inflation’s impact on the costs of goods and services, including elevated gas and grocery prices, are contributing to Canadians’ financial stress. As Canadians struggle to afford groceries, gas and other goods and services, nearly half have less disposable income compared to a year ago.

However, the research also shows that working with a professional financial planner is helping Canadians manage.

“Canadians continue to struggle with their financial picture, and financial stress can have a significant impact not only on financial well-being, but also on mental health,” said Tashia Batstone, president and CEO of FP Canada. “The good news is this research demonstrates a clear path forward for Canadians. Working with a certified financial planner professional or qualified associate financial planner professional can help individuals regain control over their finances and reduce stress.”

Survey respondents reported that setting money aside is a struggle. Saving enough for retirement (35%) and saving for a major purchase (32%) are two areas of growing concern. Younger generations are also more likely to feel the pinch, and Canadians aged 18 to 34 are the most concerned about saving for major purchases.

“The current economic challenges have heightened Canadians’ sensitivities surrounding their personal finances, but it does not mean you have to go at it alone,” said Meghan MacPherson, a QAFP professional at Impact Financial Group Inc., in St. Catharines, Ont. “With the cost of living on the rise, Canadians should be leaning on professional financial planning advice to alleviate money-related stress.”