Escalating costs are creating hardship for households worldwide and many companies are also at risk of staying afloat. In particular, our construction industry has seen significant cost increases over the last 24 months driven by significantly higher than expected costs for labour and material supply.

In many cases, our supply chain has taken the initiative to provide early warnings of pending cost increases, which has allowed contractors to cater for these foreseeable costs. However, current market volatility and persistent rising costs have led our supply chain to limit their exposure by providing pricing with very short term validity. Similarly, subcontractors have not been prepared to take on escalation risk when quoting for work, passing on this risk to head contractors.

The two main risk areas are project costs exceeding tendered allowances and contracts with commercial terms that do not adequately cover the cost of escalation over the contract period.

Labour Costs

Pressure on labour costs has largely come from the closure of borders limiting the pool of available in-country construction labour force (both skilled and unskilled).

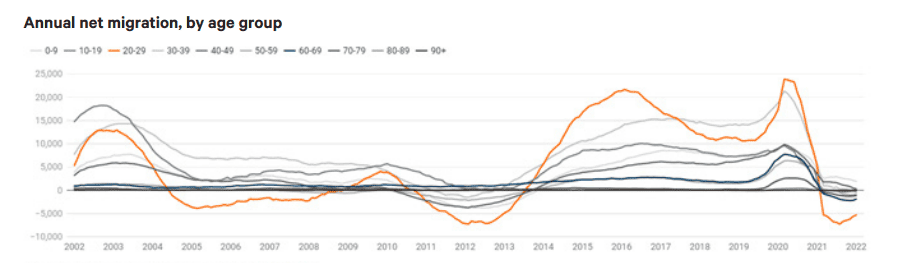

Given the net migration loss many countries are experiencing and the attractiveness of opportunities in other countries, it is expected that pressure on labour resources will continue for some time, particularly in regard to young skilled labour.

Conversely, the opening of border with other parts of the world will also create an opportunity for more immigrants to enter the construction workforce. The graph below highlights recent trends, particularly with respect to skilled labour in the 20-40 year range.

Construction labour costs have increased at an average rate of just under 4% per annum since 2019 and are expected to continue at around 3-5% per annum through 2022.

On various projects, we have experienced quoted subcontract labour increases of up to 16% and combined material/labour increases of up to 20% over the 12-24 months.

Our external labour hire rates have similarly experienced increases of 6% per annum since 2020.

Wage inflation also continues to increase with further Government regulation (e.g. minimum wage has increased by 27% in the last three years). The labour cost forecast shows a steady increase over the last three years and is expected to continue.

Material Supply Costs

We have all seen the significant increases across the board with the costs of living.

Construction material is no exception and we have seen significant cost increases over the last 20 months due to what could be termed a perfect storm resulting from:

- Loss of production time as a result of lockdowns in the early stages of the pandemic

- China being offline for a period of time in 2020

- Substantial and extraordinary increases in shipping / transport costs

- High demand for material as we recover from COVID impacts worldwide and industries return to original levels of demand (if not greater).

These factors have resulted in extraordinary increases in construction material prices, notably steel and concrete/ plastic pipe material has increased over 30%, timber 20%, and concrete over 15%.

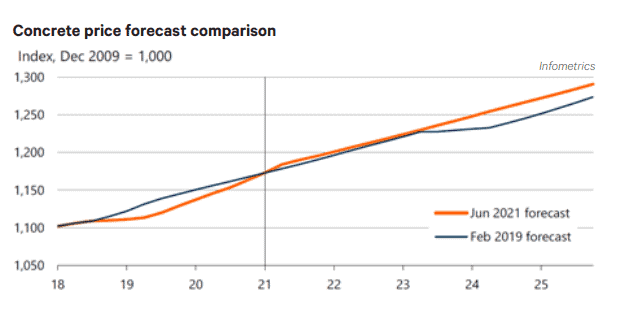

Concrete costs have increased steadily since 2019, driven by continued strong levels of construction activity, particularly residential housing. Costs for concrete products, and in particular, piping, have increased up to 15% over the last six months.

“A combination of strong demand conditions, international supply chain disruption, higher shipping costs, and increased energy prices point towards upside risks to our outlook for concrete prices over the next 18 months.”

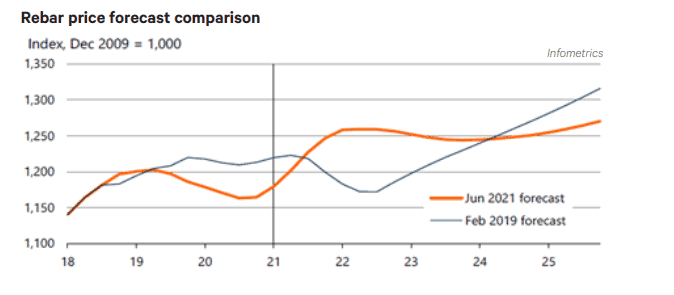

Again, our projects are experiencing these increases with structural concrete prices increasing 5% over an 18 month period and around 7% for reinforcing steel.

Steel supply costs internationally have reached levels not seen since 2008.

With China accounting for a major share of the world’s steel supply, there has been a substantial cost increase driven by the Chinese Government’s move to restrict manufacture and reduce carbon emissions. These enforced production cuts had the effect of raising Chinese domestic steel prices due to increasing supply and demand.

Internationally, the demand for steel as economies reopen and stocks are depleted has resulted in increased costs. Even when demand eventually fades, restocking is likely to keep steel markets tight.

Examples of current steel cost increases:

- Major steel suppliers advising in mid-2021 that reinforcing steel prices are increasing around 12% from September 2021

- A major steel fabricator has advised a 75% increase in material cost:

- Steel plate increasing from an average $1,350/T in Nov 20 to $2,300/T in September 2021

- Profile section increasing from an average $1,450/T in Nov 20 to $2,100/ in September 2021

- Hollow Section increasing from an average $1,600/T in Nov 20 to $2,700/T in September 2021.

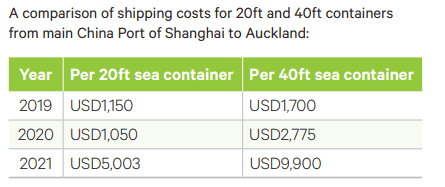

As mentioned earlier, shipping costs have increased significantly since the start of the pandemic and borders were closed reducing air and shipping movements worldwide. Consequently, imported material costs have similarly increased largely due to increased shipping rates. From the main Asian markets this increase is reportedly to be 4-5 times higher than previous peak season rates (pre-COVID). The factors contributing to this situation include:

- Airlines stopping and/or reducing air freight services as borders closed to passengers and aircraft were parked up in the early stages of the pandemic (2020)

- China resuming production in 2020 and fulfilling orders delayed by the initial COVID lockdown. As a result, large product volumes were pumped out of Chinese factories to the extent that there was insufficient shipping space available for the outflow of goods

- Shipping lines (facing 100% booked vessels) increased their shipping rates either through direct rate increases or surcharges

- Air freight costs skyrocketed as sea freight transport issues forced freight towards air services, which were already significantly reduced in capacity

- Locally:

- Factors including adverse weather, significant incidents (Suez Canal), COVID re-emerging in China, waterfront industrial action (Australia), etc., saw vessel schedules severely disrupted resulting in “bunching” causing ports to quickly congest and struggle to handle the volumes of containers having to be processed

- The introduction of port congestion

It is expected that import container rates from 2021 levels will not increase greatly for 2022 and onwards as they are now at levels generally considered unsustainable for many industry types to continue their businesses. In addition, there have been new services to by shipping lines which will have the welcome effect of increasing shipping capacity and hence reduce any potential likelihood for further rate increases.

Other Pressures

Increased levels of government and local council investment, coupled with more energy investment, could maintain greater upward pressure on infrastructure prices.

Over the last 18 months, central government has indicated its intention to significantly increase its infrastructure investment across a wide range of projects, but progress to date has been very limited. If activity does get underway soon, current capacity pressures in the civil construction industry will result in sustained pressure in supply and demand in all of the areas discussed above.

Bitumen

The treatment of escalation with bitumen has typically been dealt with directly and specifically in many roading contracts, which is separate to other material cost fluctuation risk treatments. Bitumen risk treatment involves the use of an index based method and/or the bitumen volume-based method based on the Bitumen Cost Adjuster (BCA). The BCA uses the Z energy list price to determine changes in pricing. Previously, pricing for High Sulphur Fuel Oil (HSFO) was used as a marker. However, recent changes in international marine regulations has resulted in a move away from HSFO making the use of HSFO as a marker inappropriate.

The adoption of the BCA using the Z energy list price has been shown to be a fairer means of determining true cost movements with bitumen. However, its introduction late 2019 has meant that bitumen cost fluctuations prior to this date have not been correctly and fairly addressed.

The two primary bitumen grades used are not readily available from international refineries and not manufactured to the NZTA M/1 specifications. Hence, it is likely that imported grades of bitumen will need to be modified, adding further cost to the final product.

Other challenges include storage capacity and compliance with the M/1 specifications. The industry will need to work closely to mitigate these immediate issues including flexibility and fairness in their procurement models in both construction and maintenance contracts.

Addressing Escalation Risk in Construction

Current Approach

On tenders with no escalation provision (as such the escalation risk is to be managed by the Contractor), our approach has been to allow a risk provision in our Risk & Opportunity (R&O) register. This risk has generally been dealt with in two ways.

- Price the escalation risk contingency over two tranches:

- An escalation cost allowance calculated on the basis of anticipated annual percentage increases for labour, material, plant, subcontract, etc. based on the anticipated cash-flow over the life of the project

- An additional escalation risk contingency calculated as above but utilising higher value annual percentages than in 1 above; on the basis that escalation will run higher than anticipated. This additional escalation risk provision is then included in the R&O Register with a probability weighting applied.

This approach has been used extensively on larger value opportunities typically with collaborative type procurement models where this approach is reviewed with clients and their representatives.

- Price the escalation risk in the R&O register as per ‘ii’ above, calculated on the basis of anticipated annual percentage increases for labour, material, plant, subcontract, etc. over the life of the project with a (high) probability weighting applied. This is the more common method adopted on the smaller value opportunities.

Clearly, there is no simple solution to valuing cost escalation risk, particularly given the current market. Appreciating current market conditions, including local variations, is important for making effective decisions on appropriate treatment.

Moving Forward

It is clear that increased costs associated with labour and material have driven escalating costs on projects and created challenges in forecasting risk contingency in our tenders.

In looking for a solution, there was a strong view that we need a collaborative approach to address the issue and discuss a shared risk approach involving both contractors and clients. This collaborative approach depends largely on the willingness of clients to engage with contractors on dealing with this risk.

It is recommended that a high-level approach be taken first with clients to gauge their understanding of the issue and consequently, their willingness to engage in a discussion on how to fairly address this risk. The discussions may follow two avenues, depending on the status of projects.

For existing contracts (where there are no contractual provisions to recover escalation costs), there are two possible options:

- Propose a formula approach based on indices from Statistics. While the indices are industry specific, they are national indices, so do not consider any regional variation which may occur. Another problem with this approach is that in the current rising cost market, there is a lag between when costs rise and when these are reflected in the updated indices, so there is a risk of under recovering actual costs. It will also be difficult to implement a formula partway through a contract and there needs to be transparency on how the tendered price was developed.

- Adopt an open book approach with the client and show the actual cost increases. It will be necessary to open the books to show how costs were developed at time of tender and demonstrate the increase in costs. This option is likely to be more preferable for clients as they know they will be paying actual costs (plus an agreed margin).

For tenders the same two solutions are proposed i.e.:

- A formula approach based on indices – likely to be the preferred option for clients based on its transparency and ability to manage budgets more effectively.

- An open book approach showing actual cost increases. For this method, base costs of suppliers and subbies should be verified pre-award, requiring an open book approach where clients/client representatives verify prices in the tender.

It is also conceivable that clients will only accept escalation risk if it exceeds an agreed percentage or value. Any increase beyond this amount will result in the contractor being reimbursed (for materials and subcontractors). However, it would not be unreasonable for the contractor to carry the escalation risk for costs that may be considered more manageable such as labour and plant resource.

Beyond these approaches, another solution is to simply allow a risk contingency within tender proposals, as outlined previously. Although difficult to quantify, the above data may assist towards determining an appropriate value.

Other potential solutions may be in the form of the risk treatment. This may include:

- Redesign or material substitution – If a particular component of the works is subject to supply constraints or a higher inflationary risk, the risk may be at least partially eliminated through redesign or material substitution e.g. use local supply

- Early procurement – The risk may be managed by early engagement with the market or supply chain, for example, the early procurement of material

- Free issue material – the Client undertakes to supply the material as free issue.

With the cost volatility in the current market, it is extremely difficult to predict with any certainty what escalation costs are likely to be. It has even been acknowledged by client representatives that “whatever escalation value we finally agree…it is likely to be wrong.”

The principle that neither party (client or contractor) should profit from escalation is one to be adopted in any contract negotiations involving escalation costs.

There are many popular Tower Defense games. Some of the best games include Bloons TD 6, Kingdom Rush Vengeance, Plants vs Zombies, and our web site has them all.

I have some relations with men who specialize in supply chain management